June has come and gone and so we pass the half year mark of 2020 and what a year it has been so far. I hope my dear readers are still staying safe and where possible are enjoying some well-earned time off.

Thankfully I can still count on my dividends rolling in. Unfortunately I’ve suffered my second dividend loss in the shape of a -39% dividend cut from SPG. It was expected but that doesn’t make the sting any less.

So for now I’ve had Disney cut/suspend their dividend completely and SPG with a big cut. The good part is that these two companies represent the smallest positions in my portfolio (2 and 4 shares respectively) so the total impact on my forward income (which now stands at €1379) is relatively low.

| Ticker | Amount (€) |

| INTC | 2 |

| AFL | 7.66 |

| ADM | 18.94 |

| PFE | 14.28 |

| UPS | 6.07 |

| IBM | 12.24 |

| UN | 13.96 |

| 3M | 13.22 |

| WBA | 9.95 |

| PRU | 15.87 |

| ORI | 12.91 |

| O | 4.04 |

| ED | 4.58 |

| VFC | 2.16 |

| UNH | 3.77 |

| QCOM | 9.35 |

| JNJ | 2.26 |

| Total | €153.26 |

No less then 17 companies our paying me this month. I’d like to note that this is my highest dividend income ever and that I crossed the €150 mark in a quarter-ending month. The first and second month of the quarter are a bit behind in monthly totals so I need to work on those to provide a more evenly distributed dividend total.

And onto the visuals:

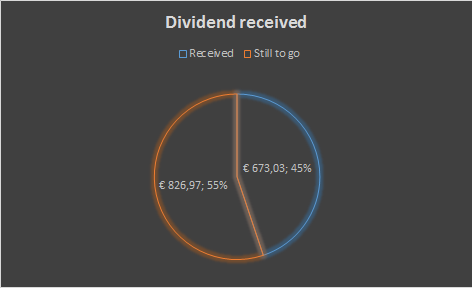

And working towards my goal for 2020:

So we’re halfway through the year and I’m at 45% of my goal for 2020. I’m a little bit behind schedule and we have one (very) big expense coming up since we are buying the ground on which our house is built! This will severely limit my abillity to do some extra deposits in my investing account, but nonetheless its a different investment in our future. 🙂

June 2019: €81,95

June 2020: €153,26

An exciting 87,02% growth compared to June last year. As always my results are converted from their base currency to euro and are post-tax.

I would love to hear your thoughts on the results of this month and ofcourse on your own results. Please let me know in the comments!

Indrukwekkend maandresultaat! Super mooi om te zien hoe je inkomsten zijn gegroeid van 2017 t/m nu. Ik hoop over 3 jaar ook op jouw niveau te zitten. Keep up the good work en ik kijk uit naar je verslag van juli. Stay safe!

LikeLiked by 1 person

Ja ik ben er ook erg blij mee. Consistentie is de sleutel tot succes en dat geld ook voor DGI! 🙂

Yes, I’m also pretty excited about my results. Consistency is key and DGI is no different! 🙂

LikeLike

Outstanding work, Mr. Robot. Congrats on the record total! Weren’t you striving for $100 not too long ago? Now look at you.

Your list of dividend payers has grown impressively, too.

It seems you’ve shortchanged yourself on the YoY growth. Eyeballing it, it seems you are closer to 90%.

I’d say you’ve had a terrific 1H of 2020. Here’s to more of the same in 2H.

LikeLiked by 1 person

Hmm that I need to redo my calculations, I’ll look into it!

Funny thing is, in the comments from june 2019 YOUare the one that actually prediced that I would be having 100+ months in no time 🙂

LikeLike

Lekker om alweer boven de €100 te zitten. Ondanks de verlaging van het dividend bij SPG vind ik zelf wel positief dat de dividendbetaling weer hervat is.

LikeLike

Congratulations also on breaking the 150 mark, it looks like a competition 🙂 200 by the end of the year?

LikeLiked by 1 person

I’m game ofcourse, but adding another 50 euro per quarter would be quite the stretch goal. Are we talking EUR or USD, pre or post-tax? 🙂

LikeLike

Congratulations on the personal record Mr. Robot! Dividend investing is just the best. Soon, you’ll be crossing $500 in a month and pushing towards $1,000.

Bert

LikeLiked by 1 person

Hey Bert, thanks for dropping by! Let’s hope that I can continue the growth of the past three years!

LikeLike

Great month Mr. Robot, I can see it’s the biggest amount so far this year.

I am sharing the dividend loss from Disney. SPG is still providing a great dividend yield, even after their cut but I decided to go with other REITs from different industries for now. SPG is on my shortlist, however.

By the way, congrats on the decision to build a house, I think it’s a great investment to your wellbeing. Maybe I will do the same one day 🙂

LikeLiked by 1 person

Hi BI, I’m looking forward to seeing your new buys.

We are not building a house we are buying the land under our current house. We have leased the ground for the past years and are now taking complete ownership. This wasn’t possible at first but is now due to a change in policy in our city. Its definitely an investment!

LikeLike

Ahh, ok, that’s even better 🙂

LikeLiked by 1 person

Hi Mr. Robot:

We shared quite a few payers this month. I also took the hit from SPG but I’m not overly concerned as I feel they will eventually make it through the COVID crisis. In fact I’ve been adding a little bit here and there to SPG.

Also congrats on the land purchase – in the long run it should pay off quite well. I typically travel to the Netherlands every year really enjoy it there- – typically base out of AMS – ik ben ajacied 🙂 Tho you are from the south so maybe a PSV fan or if really south Roda? Assuming of course you like voetbal.

LikeLiked by 1 person

Hi D4J, welcome to the blog and thanks for your comment.

I’ve seen quite a few people adding to their SPG stock totals. I haven’t done it myself, but am still confident that they will come out on top.

I’m not really an active supporter of any soccer team (although I play it myself competitively) but since I’m from the South if there would be any team it would be Feijenoord. 🙂

LikeLike

Yes I hope they do (SPG)…I feel like the market is mostly overpriced so trying to find some bargains where I can … For soccer— I play as well here in the states… next time I’m headed to Ned I’ll ask you for some nice places to visit in the South Rotterdam is as south as I’ve been.

LikeLiked by 1 person

Allright let me know and I’ll find some nice spots to visit. 🙂

LikeLike