It’s been four months since I lasted posted here. Visitor counts have dropped significantly although I did post some reactions on other blogs. Content is king and it has been lacking. 🙂

No worries, I’m still here and still grinding away towards financial independance. One buy and one stock at a time despite what Mr. Market does. And boy, has it been a wild rollercoaster ride in the past few months.

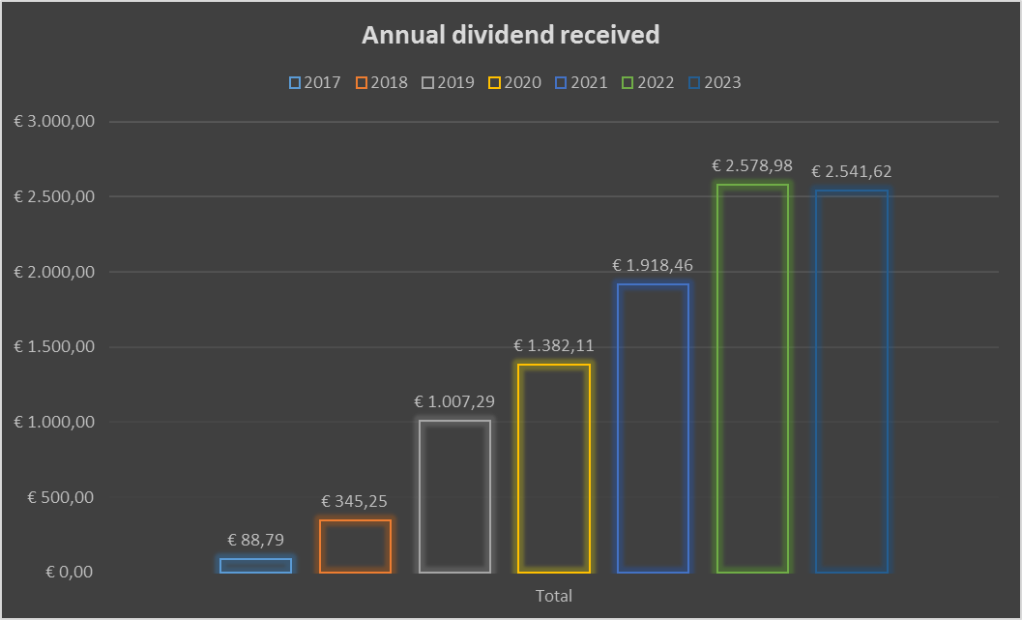

Since I missed a few monthly updates, I’ll do a quick recap of my dividend results:

May 2023: €171,56 (a -1,44% “growth” compared to last year due to other payout shedules and sold position.)

June 2023: €581,85 (a spectacular 42,23% growth compared to last year)

July 2023: €135,68 (a small 2,45% growth compared to last year)

August 2023: €144,23 (a respectable 14,63% growth compared to last year)

September 2023: €672,47 (an awesome 34,83% growth compared to last year). The motherload! My PR of all PR’s! My largest dividend haul ever!

The visuals (I had to adjust my scales!) 🙂

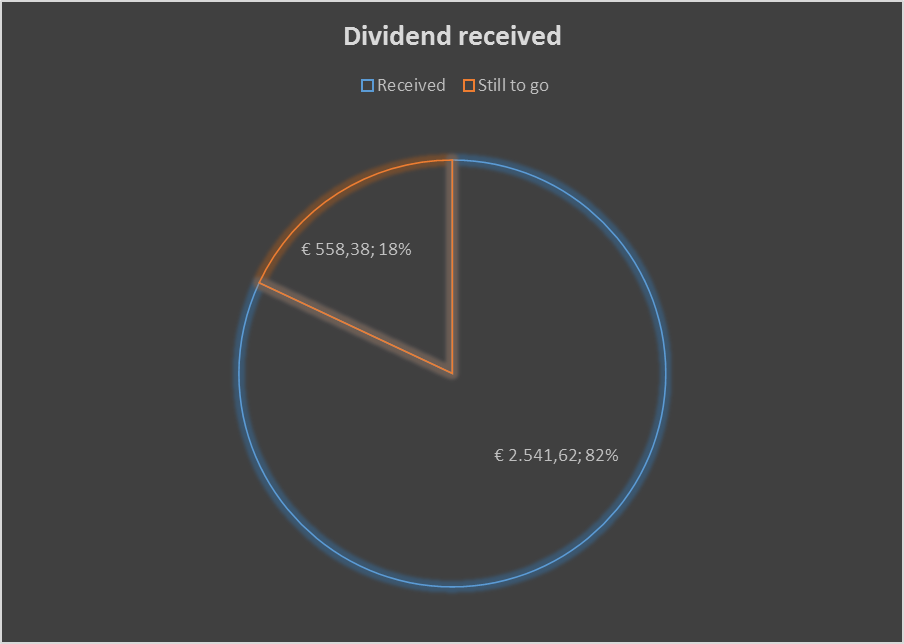

I’ve set the rather ambitious goal of receiving €3100,- (netto) in dividends, which is an increase of €521,- euro compared to 2022!

My annual progress:

My PADI progress:

And there you have it, my results from the previous months. What do you think? Did you miss me? Let me know in the comments!