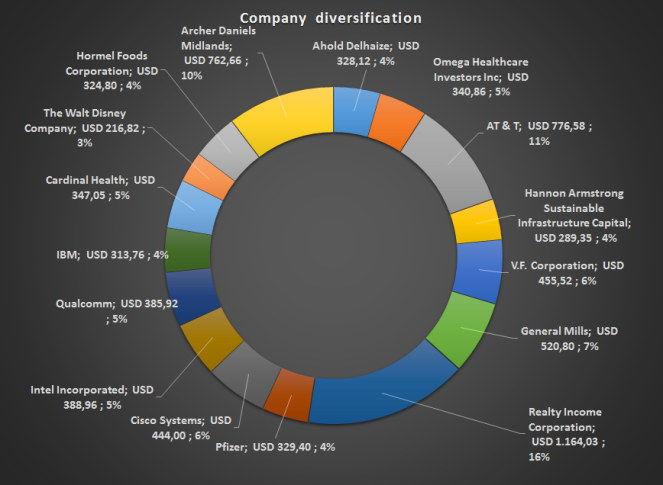

So I’ve posted all of my monthly buys, but I never posted a complete up to date overview of my current portfolio. Which means I also didn’t analyse it enough to check on my diversification which ofcourse is a bad thing. So I thought its time to post an overview for you all to roast 🙂

Current portfolio including current market value and total weight on the portfolio:

This is the sector diversification:

And the country diversification, granted this is somewhat askew since a lot of the companies I invest are multinationals with presence around the globe:

Well my dear readers, I would very much like to know what you think of my current portfolio? Don’t pull any punches, I can take it. 🙂

Also I would be interested in any recommendations for stocks you can give me to further diversify (no oil, tobacco or weapons though)?

Hi Mr. Robot, I think it is a well diversified dividend stock portfolio. It’s hard to be critical of anything. I own many of the same companies. But since you asked for constructive feedback, I would say 16% of the pie is pretty large for one stock. Even if it is O, a company and stock I own and highly value too. Tom

LikeLiked by 1 person

Hi Tom, thanks for the feedback! I definitely agree with you. My latest buy in February doubled my position in O and this clearly shows.

My next buy will surely not be O 🙂

LikeLike

Hi there. Nice portfolio. Most of share im investe too. T, PFE, INTC. Would love to own OHI, O, GIS, CSCO and HRL as well. Nothing to add all are exelent choices 🙂

LikeLiked by 1 person

Hi P2035, really appreciate your input. Thanks!

LikeLike

Nice portfolio. Small question. I assume your Ahold shares are bought in the Netherlands, not in the US? I take it you just report in USD for cosistency?

LikeLiked by 1 person

You are completely correct P2F! I have everything in euros for my monthly dividend reports but thought it would be easier the other way around for this report. Especially with my international audience. 🙂

LikeLike

Thanks for sharing your portfolio diversification, Mr. Robot! Diversifying my portfolio has been on my mind a lot lately. I did write a post recently breaking down the sectors called “The Business & Culture of a Dividend Income Portfolio.” At the moment, my portfolio is very small. It’s weighted mainly in utilities and financials and Canadian stocks. I plan on adding more U.S. positions. I like your positions in IBM, Walt Disney, O, and CSCO. I eventually plan on buying them all.

LikeLiked by 1 person

Hi RTC, great to see you here! Vice versa I want to add more Dutch stocks and US utilities 🙂

LikeLike

Hi Mr. Robot,

Thanks for sharing your portfolio. You have some very good companies and overall portfolio looks quite solid.You got too much O, not necessarily a bad thing though given O’s quality. But even best of the best company has its risks. So as long as you are comfortable with that, that’s fine.

You don’t have any utilities? You can get some great yields in utilities these days with not too shabby growth. Many of the blue chip utes are yielding upwards of 4+% and even 5% yields with 3 – 4% DGR. Checkout SO, DUK, D, ED, and PPL. I own them all. D is my favorite given their 10% DGR and having an underlying MLP play. I recently wrote about them on my blog.

Also, you have REITs listed as Financials, it used to be that they were part of financial sector along with banks and such. But now, REITs have their own sector. So essentially, you don’t have any stocks in financial sector.

I personally don’t like to invest in banks, mainly because they are hard to figure out and I just don’t trust them. Though I still have positions in other financial stocks like ORI (insurance) and MAIN (BDC). ORI is a div aristocrat/champion. Very stable. They just gave a special dividend of $1/shr and a separate 2.6% raise. My ORI div yield for 2018 is over 10% including special dividend. The div growth is not that great and you can’t count on special div every year, but it’s okay given their stability and long dividend record.

MAIN is a bit risky but one of the best BDC companies and a monthly div payer. They also give out special div semi-annually.

Hope this helps,

Take care

LikeLiked by 1 person

Hi Mr.ATM! Thanks for you extensive answer and suggestions. I will take them to heart when deciding my March buy. Utilities are indeed lacking and so it seems Financials as well. I’ll be sure to remedy that in the future!

LikeLike

Well I guess I would prefere more diversified portfolios by contries. For now it seems that all the eggs are in one basket even thought the fund is well distributed by sectors.

LikeLiked by 1 person

You are right. That’s why I bought more NL stocks recently and I’m going to continue doing that to equal the balance.

LikeLike