And with that the last day of October is gone and we have finished the first month of the last quarter of 2020. A month where two things dominate the news, Covid and the US presidential elections (even here in The Netherlands).

For me its 100% working from home again. I finally moved my temporary desk to the attic and am no longer working from the living room. That is a vast improvement with staying focused (especially with kids) and dividing work and private life again.

Here are the results for October 2020:

| Ticker | Amount (€) |

| PEP | 3.69 |

| PPL | 6.9 |

| IRM | 26.89 |

| KMB | 3.87 |

| HASI | 3.65 |

| LEG | 11.6 |

| CAH | 9.15 |

| O | 3.89 |

| CSCO | 12.67 |

| FDX | 3.29 |

| ADP | 4.6 |

| MDT | 2.22 |

| SPG | 3.73 |

| Total | €96.15 |

No less then 13 companies payed me this month, with no new companies. A total of €96,15 was deposited into my account, which is irritatingly close to the €100 mark in the first month of a quarter.

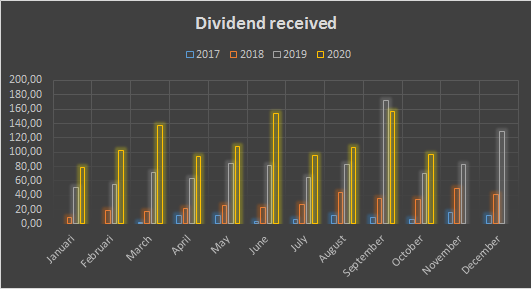

And onto the visuals:

And working towards my goal for 2020:

So we’re finished with month #10 and I’m at 75% of my goal for 2020. I’m still behind schedule and I might need to face the fact that my target for this year was somewhat too high (especially with buying our land). We’ll see how close we can get!

October 2019: €69,63

October 2020: €96,15

Total dividend ever: €2570,13

A nice and comfortable increase of 38,09% compared to last year. The progress is still very real even though this is already my fourth year as a dividend growth investor since starting back in March of 2017.

As always my results are converted from their base currency to euro and are post-tax.

I would love to hear your thoughts on the results of this month and ofcourse on your own results. Please let me know in the comments!

Nice almost 100$ in off month 🙂 And superb job going that 1k$ this year. I should hit 1k€ myself next year if nothing bad will happin. For ex BPY or XOM will cut their dividends 🙂

LikeLiked by 1 person

Hey P2035, thanks! I hope that the worst of the cuts is behind us, but you never know. That why we diversify our holdings. 🙂

LikeLike

That’s still a nice month. Sometimes you just want to push that dollar in the right direction 😉

LikeLiked by 1 person

My thoughts exactly, all numbers are somewhat down compared to earlier this year solely due to the conversion rate.

LikeLike

Nice month, Mr. Robot! Even though you didn’t meet the hundred mark, you achieved an excellent YoY growth rate. Glad to hear you are enjoying work from home. I’m enjoying it too. Keep it Up!

LikeLiked by 1 person

Hey RTC, thanks for stopping by! I’m still happy with my growth rates, I hope to keep them up the coming years.

LikeLike

Splendid month, Mr Robot! I really like your diversification strategy in order to minimize the impact of div cuts. What are your thoughts about the dividend safety of your largest contributor IRM?

LikeLiked by 1 person

Thanks DKK! I’m somewhat worried about it, but have decided not to take action. They are also pretty diversified and migrating business to the cloud which happens to be my work area (and where everything seems to be heading).

So I’m not adding at the current levels which I would have done if the situation were better. I’m continuing to hold and expand other positions.

LikeLiked by 1 person

You weren’t kidding Mr. Robot, that was a good report. You’re going to hit that triple-digit in no time, but congrats on the double-digit increase from last year.

Regarding your goals, I’m reminded of a quote by Michelangelo which says, “the greater danger for most of us lies not in setting our aim too high and falling short; but setting our aim too low and achieving our mark.” Clearly, you weren’t one of those who set the goal too low. It’s ok if you don’t make it, as long as you continue working towards that goal. Definitely good luck on that front and I can’t wait to check out next month’s report.

LikeLiked by 1 person

Thanks for the inspiring quote DP, I love it!

LikeLike

EXCELLENT Mr. Robot. That is what I am talking about that right there. Way to nearly cross the 100 Euro mark in this “off month.”

Bert

LikeLiked by 1 person

Hey Bert, thanks for dropping by!

LikeLike

That is a big IRM payout relative to the others, Mr. Robot. Sounds like you are going to build up the other positions to make the payouts be more even over time. If so, I like that plan.

I share 5 of your 13 payers this month. Your portfolio is growing nicely, especially the number of payers each month. I can’t believe you are up to 13 already.

Triple- digit off months appear to be right around the corner… Congrats on all your progress.

LikeLiked by 1 person

Hey ED, awesome to see you here again! Thats exactly my plan, you know I never really like outliers like that in my month.

LikeLike